Taxes will be taken out automatically and his compensation will be consistent. If he has $120,000 in owner equity, including his original $50,000 contribution and earnings from past years. If Charlie takes out $100,000 worth of an owner’s draw, he runs the risk of not being able to pay employees’ salaries, fabric costs and other various expenses. When taking an owner’s draw, the business cuts a check to the owner for the full amount of the draw.

Distributions come from earnings that were previously taxed at your personal rate. As the owner of an S corporation, you first need to figure out a reasonable compensation for your work to determine your salary. This should align with what people in similar roles at other companies earn to not raise red flags with the IRS. The legal structure of your business is the starting point for the entire payroll process. As the business owner, you are still entitled to draw money from the business in the form of a shareholder distribution. However, distributions cannot be used in place of a reasonable salary.

Owners must pay them self-wages that are subject to Social Security and Medicare. However, any company profits flow to the owners free of employment taxes. Draws are not personal income, however, which means they’re not taxed as such. Draws are a distribution of cash that will be allocated to the business owner. The business owner is taxed on the profit earned in their business, not the amount of cash taken as a draw.

Problems You May Encounter When Paying Yourself: Manage Your Money Wisely

You can take out a fixed amount multiple times (similar to a salary) or take out different amounts as needed. If you own a single-member LLC, or are part of a multi-member LLC, you’ll need to use the draw method to pay yourself. As the sole proprietor, you’re entitled to as much of your company’s money as you want. You don’t have to answer to stockholders or shareholders, leaving you free to take payments as you see fit. For example, if you run a partnership, you can’t pay yourself a salary because you technically can’t be both a partner and an employee.

- You’re a business owner, and even if your business is your baby, you still need to pay yourself enough to keep your lights on at home and ensure you have food for the table.

- For example, Charlie owns a tuxedo shop that operates as an S Corporation.

- Then, you can work out the variable expenses that are necessary for living and that change each month.

- Instead, S corp owners can draw money from the business by using shareholder distributions.

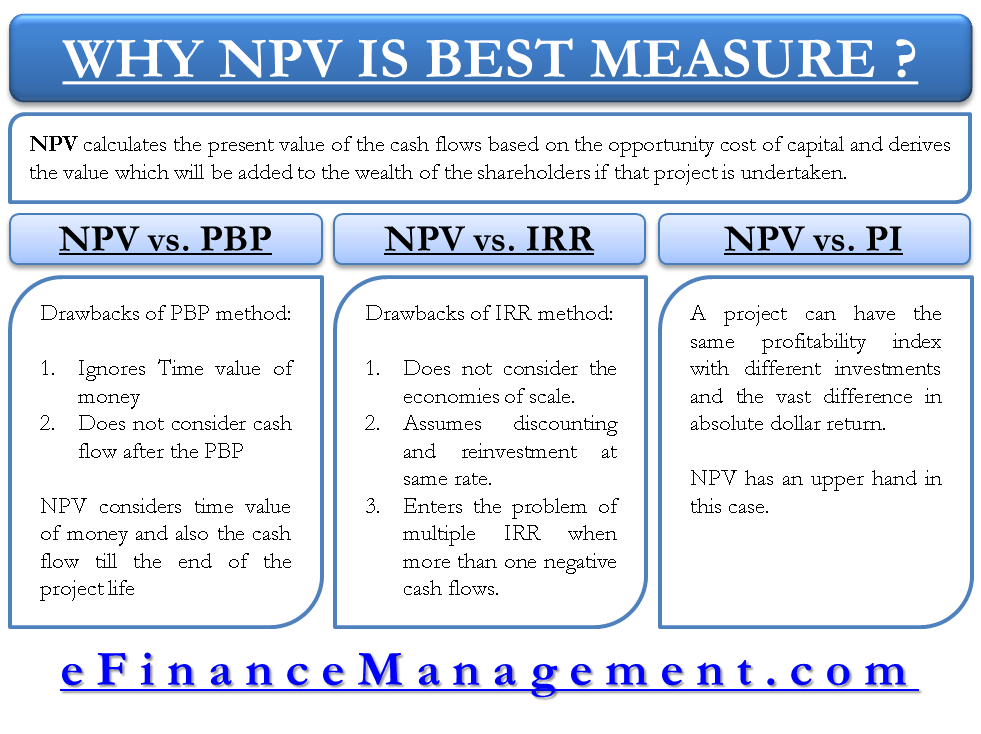

If your company grows net profits by 15% over the course of the year, then you’d take a 15% lump-sum bonus on top of your base salary at the end of the year. Once you’ve reached a break-even point in the business, it’s a good idea to correlate any salary increases (or bonuses) to the performance of the business. The best method for you depends on the structure of your business and how involved you are in running the company. Your equity is defined as the amount of accumulated value you’ve invested into the business through things like cash, equipment, and other assets. Business taxes are nothing but the taxes that your business must pay as a part of its business operations.

How much should you pay yourself as a business owner?

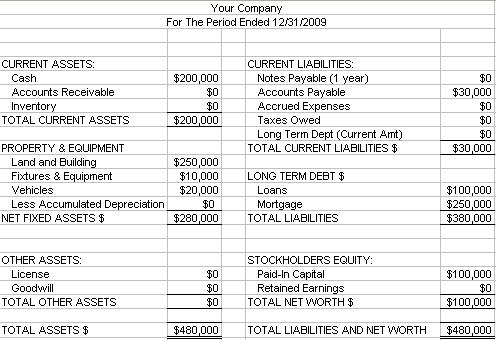

Anyway, our point here is that before you consider taking a dime out of your business, you need to make sure that your expenses will be covered. We’re going to show you how we pay ourselves in our own business, and what you need to consider. We will also tell you some of the tax implications you need to consider so you can avoid those painful IRS audits.

- Overall, the choice between an owner’s draw and a salary depends on the specific circumstances of the business and the owner’s personal financial needs.

- You will have to pay Social Security and Medicare taxes (collectively referred to as FICA taxes) whether you pay yourself via a salary or owner’s draw.

- After deducting business expenses, the next step is to find out how much you should save for your taxes.

However, anytime you take a draw, you reduce the value of your business by the amount you take out. With an owner’s draw, you decide how much to pay yourself, when, and why. One of the critical decisions that S-Corp Owners draw vs salary owners must make is how to pay themselves. However, determining the appropriate split between the owner’s draw and salary can be complex. This article will examine how S-corps determine owner’s draw vs salary.

Should I Take an Owner’s Draw or a Salary in an S Corp?

Whereas in LLCs or partnerships, the government does collect “medicare and social security taxes” hypothetically, through the self-employment tax. Also, taking a paycheck as compensation from your business will allow you to show banks a steady source of income that will make it easier to take on a mortgage or other loan. With an owner’s draw, you are able to pay yourself from the business at any time, which allows you to adjust the amount you receive based on how the business is performing. On day 1 of the partnership, outside basis is equal to each partner’s assets in the business thus it is equal to inside basis. As time moves on and business activity picks up, partners must keep track of their own share. Think of inside basis as belonging to the partnership entity as a whole.

FICA Taxes

An owner’s draw is not taxable income for the business owner since it is a withdrawal of the owner’s equity in the business. Therefore, taking an owner’s draw instead of a salary can reduce the amount of taxable income for the business. The way you are taxed on your income can also influence whether you choose to take a salary or an owner’s draw. Regularity is key when it comes to sticking to the owner pay schedule. Setting up an automatic business owner salary percentage transfer or scheduling a time to sort it out every month would be a very smart move. That way, your chances of keeping your money affairs in order increase tremendously.

This needs to be continuously self-monitored throughout the year to accept distributions. Monitoring personal tax and debt basis is the shareholder’s responsibility. The S Corporation keeps track of stock basis for the business as a whole.

In most cases, when you draw money from the business, it’s usually moved to an equity account known as the owner’s draw account. Otherwise, you can draw money from the business account (or even the cash register) and move it to your personal account. With the salary method, the business owner is treated as any other W-2 employee and receives a regular salary. Once this salary level is set, it must be paid consistently with the appropriate amount of taxes withheld on both the employee (in this case, the owner) and the business side. While it may sound ideal to have easy access to business funds whenever you choose, taking an owner’s draw isn’t the only way to get income from your business. Owners can also opt to take a regular salary instead of or in addition to an owners draw, and each method comes with certain tax implications for both the owner and the business.

Of course, it fluctuates as your net profits ebb and flow each month. Some business owners pay themselves a salary regularly, such as weekly or monthly, while others may opt for a less frequent schedule or draw funds as needed. In this article, we share payment methods, considerations, and common mistakes business owners make when paying themselves.

Putting Yourself on Your Business Payroll Chase for Business – Chase News & Stories

Putting Yourself on Your Business Payroll Chase for Business.

Posted: Thu, 01 Sep 2022 07:47:16 GMT [source]

State and federal personal income taxes are automatically deducted from your paycheck. On the personal side, earning a set salary also shows a steady source of income (which will come in handy when applying for a mortgage or anything else credit-related). An owner’s draw requires more personal tax planning, including quarterly tax estimates and self-employment taxes. The draw itself does not have any effect on tax, but draws are a distribution of income that will be allocated to the business owner and taxed. There are no specific guidelines for what constitutes reasonable compensation. It’s important to carefully consider these in determining your salary to avoid an IRS audit.

reasons your small business needs a website

For additional assistance with payroll tax services, connect with the experts at Paychex. When the owner receives a salary, the amount must be consistent from workweek to workweek, and taxes must be withheld from the salary as they are for any other employee. An owner’s draw is a way for a business owner to withdraw money from the business for personal use. To be paid a salary, business owners must classify themselves as an employee. A salaried worker receives a fixed payment on intervals decided by the company, regardless of the hours they work.

You can take home your pay through a salary, distributions, or a combination of both. The IRS has a set of rules that determine how much you can pay yourself as a business owner. If you run an S corp business, a salary and/or distribution is the right fit. Owner’s equity refers to what you’ve invested in the company, whether that’s your own personal money or your time. When you take a draw, you essentially are lowering the amount of owner’s equity.

We’ll start with each method’s main advantages and disadvantages and finish by discussing the importance of business structure. This is different from a sole proprietorship, where all net profit is reported and taxed as personal income on the owner’s income tax return. With that being said, owner’s draws are considered taxable income, and taxes won’t be deducted automatically. This means Charlie will need to tuck aside money towards federal and state income taxes as well as self-employment taxes.

Leave a Reply